Internet 3.0: Blockchain & The Trust Crisis

Rob Frasca - Cosimo Ventures

Internet 3.0: Blockchain & The Trust Crisis

Rob Frasca

As I meet LP investors, family offices, and people interested in the new decentralized trust economy, I am often questioned about blockchain; how it works, why is it so revolutionary, and as an investor, how should I think about it? I have written about the trust crisis before, on Medium.

You here the term “ decentralization “ a lot these days. Decentralization is the process of redistributing functions, people, powers or things away from a central authority.

INTERNET 1.0 and 2.0 PROTOCOLS HAVE DECENTRALIZED ALMOST EVERY FACET OF OUR LIVES

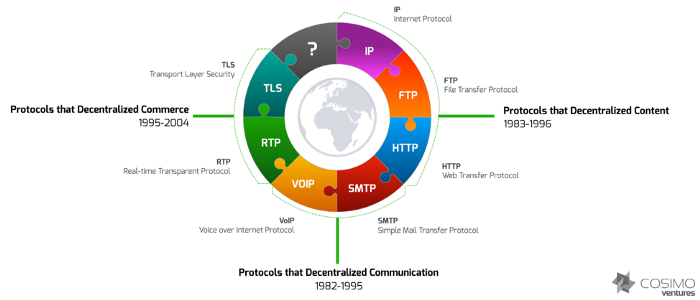

I have been fortunate enough to be an entrepreneur over the past three decades and to have witnessed new internet protocols emerge year after year. The Internet itself was originally designed to be a decentralized network that would survive nuclear attack. As the Internet has been commercialized by countless numbers of entrepreneurs and technologists, they created new protocols to solve key problems that emerged. Each of these new protocols decentralized yet another facet of our online lives.

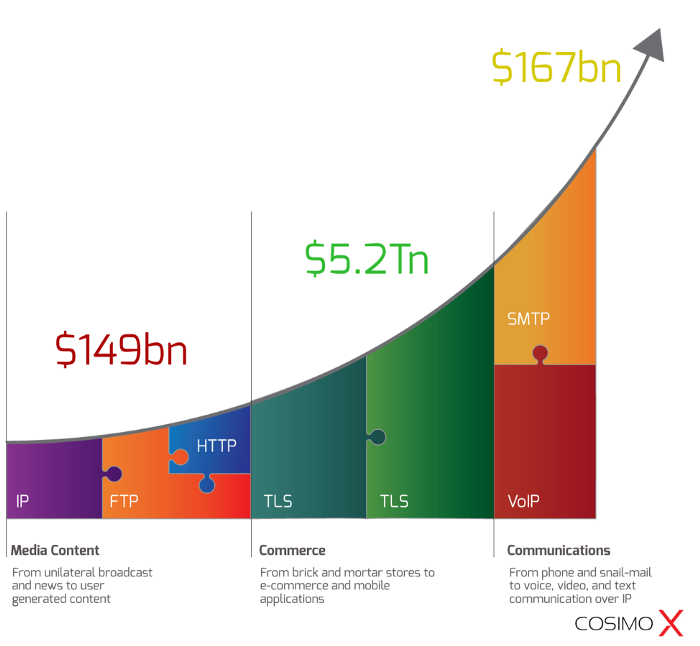

WAVES OF DECENTRALIZATION SPAWN MASSIVE MARKETS

Each cluster of innovative protocols has created massive markets. By thinking back and reasoning forward, those who create and capture the most value have been able to predict which new internet protocols will decentralize which antiquated economic honeypot.

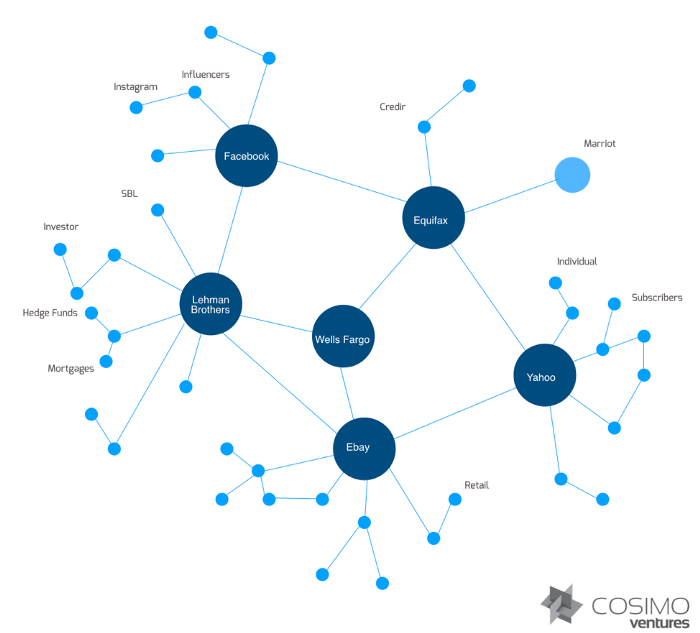

ONE OF THE ONLY THINGS STILL CENTRALIZED IN THE WORLD IS TRUST

Intermediaries have built trillion-dollar markets by positioning themselves in-between markets, individuals, and institutions. From finance, to data, to commerce, central institutions of trust have become the bedrock of our modern economy. The raison d’être of their existence is the missing trust within communities or networks, so they need a trustful intermediary to be organized.

However, centrality of this kind in an otherwise decentralized world, creates massive and concentrated points of weakness. The problem with centralized systems is that they lack transparency, allow for single points of failure, censorship, abuse of power and inefficiencies.

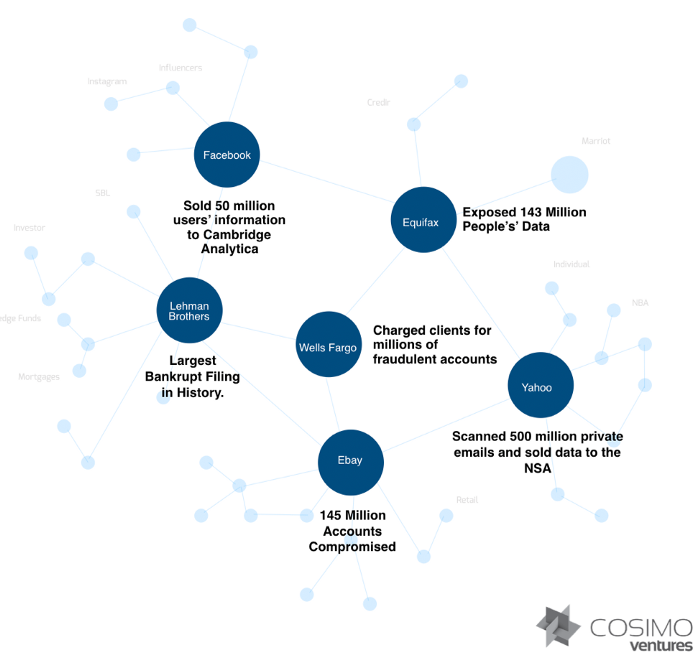

CENTRALIZED TRUST IS THE GREATEST WEAKNESS OF THE MODERN ECONOMY

Recessions, data breaches, and fraudulent activity are all a result of a concentrated trust institutions. Trillions of dollars are concentrated at these points of failure. Now, with blockchain technology, trusted intermediaries are becoming obsolete — allowing users to interact directly, immediately, efficiently, and cheaply. Economic rents are now being recaptured by users themselves.

DECENTRALIZING TRUST: BLOCKCHAIN’S FIRST USE CASE WITH BITCOIN

Decentralized trust was first shown to be possible with Bitcoin, a digital asset built on top of a new blockchain-based protocol. It has shown that the act of banking can be performed without the centralized institution of a bank.

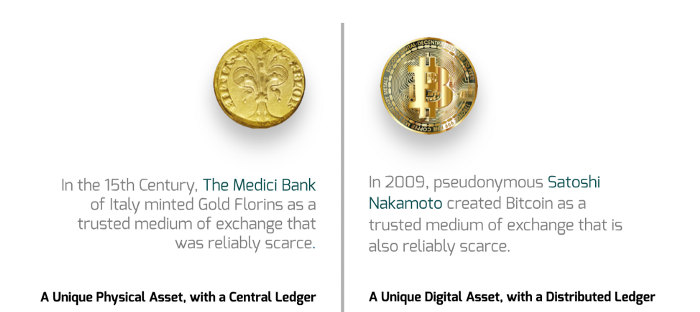

In the 15th Century, the Medici Bank revolutionized the commercial world with a centralized general ledger held by a bank and run on the Florin. These physical tokens represented value that could be exchanged peer-to-peer. However, the Bank held, updated, and controlled the centralized ledger where everyone’s balances were kept. Since the system could not work without a central repository, Florins are referred to as a centralized commodity currency.

Today, Bitcoin is revolutionizing commerce with a decentralized blockchain-based ledger. These tokens represent value that can be exchanged peer-to-peer. Unlike the Medici Bank, Bitcoin has no need for a central repository. Instead, transactions take place between users directly, without an intermediary. These transactions are verified by network nodes and recorded in a public distributed ledger called a blockchain. Since the system works without a central repository or single administrator, Bitcoin is called the first decentralized digital currency.

HOW BLOCKCHAIN PROTOCOLS DECENTRALIZE TRUST

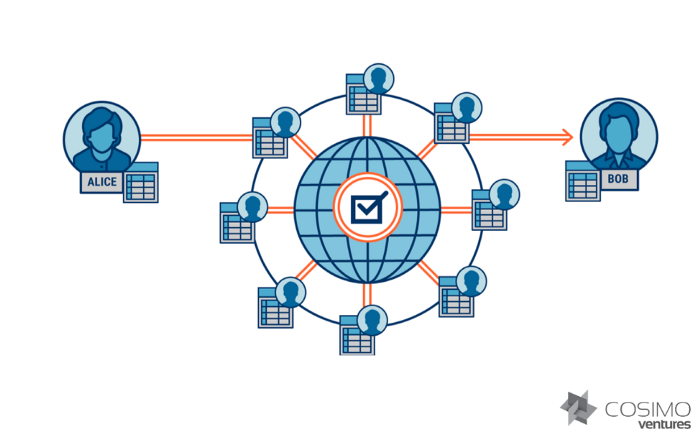

Blockchain gives us, for the first time, a way for one internet user to transfer a unique piece of digital property to another internet user, such that the transfer is guaranteed to be safe and secure, everyone knows that the transfer has taken place, and nobody can challenge the legitimacy of the transfer or overwrite the details of what has occurred.

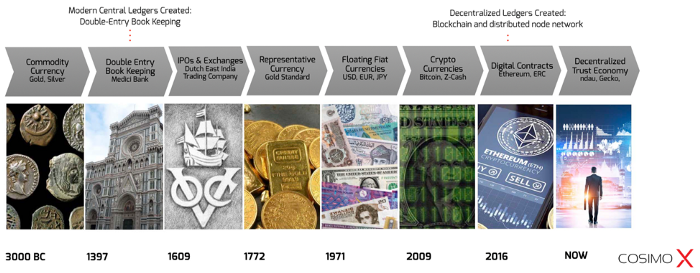

EVOLUTION OF TRUST

Bitcoin changed how we think about money. Its underlying blockchain technology is disrupting everything we know about trust.

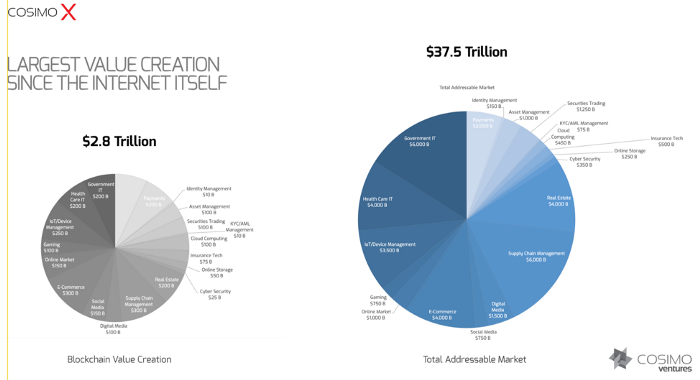

WELCOME TO THE LARGEST VALUE CREATION EVENT SINCE THE INTERNET

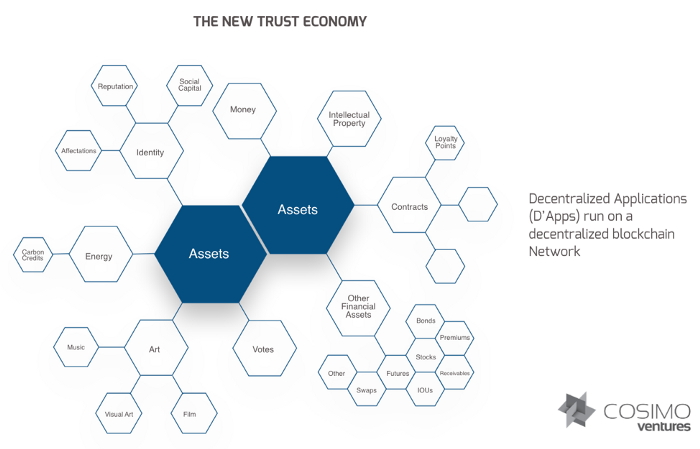

DECENTRALIZED TRUST CREATES A NEW ECONOMY

Paradigm shifts towards decentralized systems are enabled by new technological breakthroughs (i.e. blockchain, consensus mechanisms and cryptography)

What does this new economy look like?

- Existing intermediaries are replaced by digital assets and smart contracts

- The cost, inefficiencies, and risk associated with storing and exchanging value and information become unnecessary

- A new trust economy emerges that reshapes how members society interact with one another

THE DECENTRALIZED TRUST ECONOMY WILL TRANSFORM ALL INDUSTRIES

Banking & Finance: Streamline payments processing with high efficiency, fast and secure transactions empower global transactions, tearing down national currency borders minimize auditing complexity for any financial ledger

Cloud Storage: Increased security with a shift from centralized data security to decentralized network. Lower transactional costs by crowdsourcing unused storage.

Cybersecurity: Fight hacking with immutability of ledger; guarantee validity with data integrity; no single point of failure.

Energy: Fight hacking with immutability of ledger; guarantee validity with data integrity; no single point of failure.

Charity: Tracking donation allocation, accountability, integrity. Reduce Overhead and complexity of donation Payment Processing

Commercial Vehicles and Transportation: Tracking journey stops paired with IoT to create an immutable ledger of trip data.

Government and Voting: Reduce voter fraud, inefficiencies with verifiable audit trails. Minimize government fraud, digitize most processes, increase accountability, minimize auditing complexity for any financial ledger

Legal: Smart contracts with defined rules, expiration and accessibility for relevant parties.

Media: Control of ownership rights; anti-piracy / copyright infringement. Use of smart contracts for artist compensation and legal proceedings.

Medical: Drug Supply chain integrity; patient databases and indexes; transparency and automation within patient-to-hospital transactions.

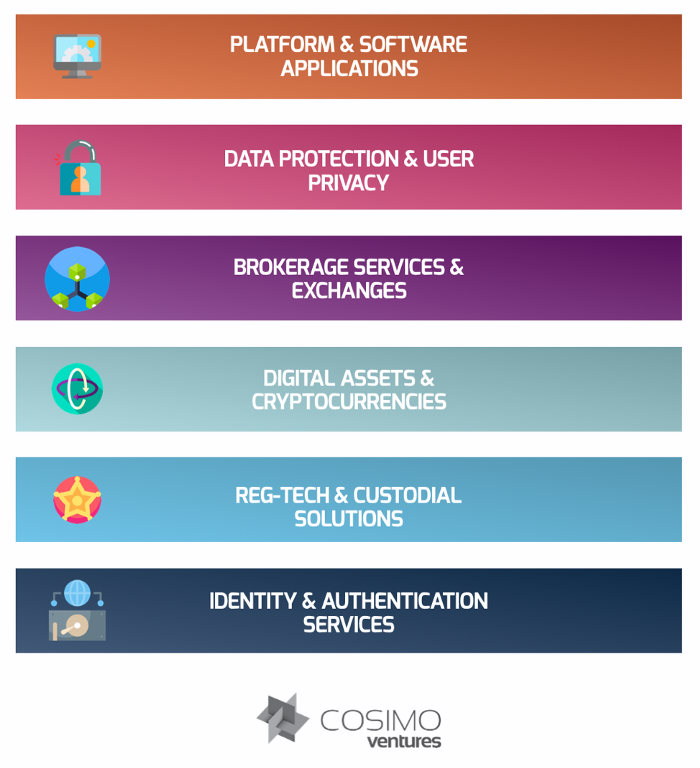

A VENTURE FUND BUILDING THE DECENTRALIZED TRUST ECONOMY

COSIMO X is a tokenized venture capital fund that invests to capitalize on the $37.5 trillion opportunity in the growth of the decentralized trust economy.

Our team seeks to invest in companies that align with the decentralized trust economy. Each layer builds upon the other to create the advanced infrastructure necessary for our economy to transition to a decentralized marketplace.

WRITTEN BY